What Should I Think Now? Responding to COVID-19 and the CARES Act.

VALUATIONS IN HISTORICAL CONTEXT

Prior to the Coronavirus epidemic, the S&P 500 (blue line) was trading 123% above the 160-year regressed mean (red line). Even after recent market volatility, the market is still trading 86% above the mean. So, public valuations remain high relative to historical performance.

Does The Cares Act create a dilemma with low-wage earners?

Though information about the CARES Act seems to be rapidly evolving, and, in some sense, changing by the hour, a potential wage dilemma could arise that could cause headaches for some employers. The issue lies in the fact that low wage earners could receive considerably more income by taking unemployment benefits than they could by earning normal wages in their job or by rejoining the employer that was forced to let them go.

In the majority of states, maximum unemployment benefits range from $300 - $500 per week. The CARES Act adds an additional $600 per week to this amount. An individual who lives in a state like North Carolina that pays a conservative $350 in unemployment benefits will now receive $950 per week. A state like Massachusetts, with a more generous $823 weekly unemployment benefit, could pay out $1,423 per week to the unemployed.

Now consider an employee in either of those states who earns $15/hour at their job: $15/hour * 8 hours * 5 days = $600 weekly earnings. It is clear that one could optimize their income potential by choosing unemployment over working a $15/hour job. In fact, in order to come out ahead of what one would make receiving unemployment benefits, a worker in North Carolina would need to earn over $23.75 per hour and a worker in Massachusetts would need to earn over $35.57 per hour.

Employers should consider the distortions that increased unemployment benefits might cause to their ability to retain workers or rehire workers, even as cheap or free money is made available for the express purpose of retaining those employees. In addition, unemployment taxes, which can range from 0.5% to over 10% depending on state and industry, should also be factored in as employers work through staffing situations.

Notwithstanding the potential difficulty in retaining employees, the CARES Act does provide excellent terms for borrowing money. The loan scenario to the right describes a company with a $3M payroll, and below are three scenarios around retaining vs. laying off employees. Loans require no guarantee, no collateral, and all amounts used for payroll, rent, utilities, and interest on mortgage obligations incurred prior to February 15th will be forgiven.

Even companies who do not need a loan to retain or re-hire employees may want to consider applying for funding as the terms and cost of this capital are very attractive.

what are payment-in-kind (pik) loans

This is a non-recourse, no personal guaranty loan tailored to your company’s specific situation. It typically has no payments due within the first one or two years and is repaid within 7 to 8 years allowing the lender to participate in the future upside of the company, but without ever having to sell any stock ownership and it’s based on the future value of your company not the current value.

Perpetuate Capital endeavors to arrange these loans between Christian Family Offices and C12 members, as lenders, and C12 companies as borrowers throughout this year.

state of capital markets survey

Perpetuate Capital, in partnership with PrivateEquityInfo.com, surveyed over 300 capital markets professionals across the country to get their sentiments on the current state of US financial markets. Below are the results of the survey, completed April 1, 2020.

How has your deal flow pipeline changed in March?

A. Significantly fewer opportunities

B. Moderately fewer opportunities

C. No change

D. Moderately more opportunities

E. Significantly more opportunities

2. Did your February and March Deals close as expected?

A. No, all transactions cancelled

B. No, on hold until the dust settles

C. Some, not all

D. Yes

3. For deals closing, how are lenders reacting?

A. Higher rates plus more equity

B. More equity required

C. Higher rates

D. No change to terms

4. When do you think private company financial projections will be reliable again?

A. 3 months or less

B. 3 - 6 months

C. 6 - 12 months

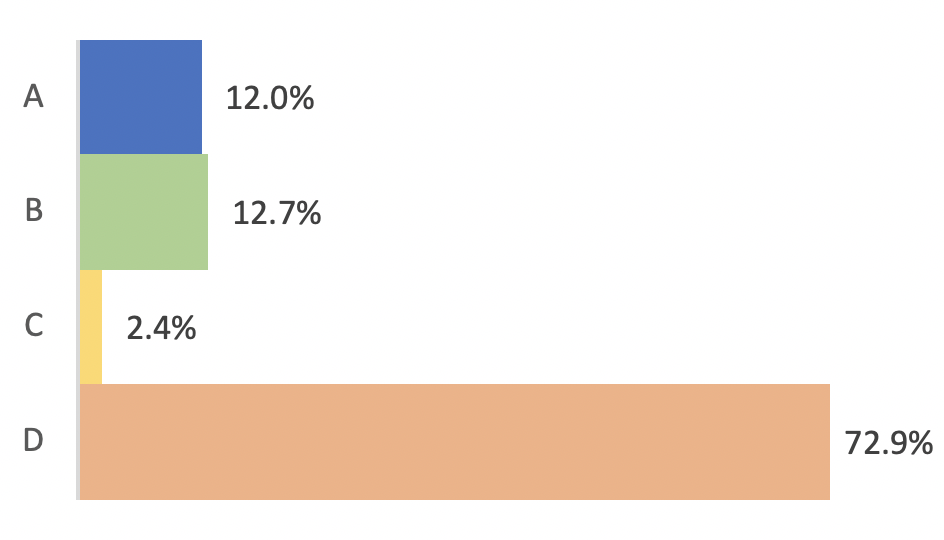

D. Over 12 months

5. How do you expect private company valuations to adjust from the current economic shock?

A. No change

B. Down 0 - 10%

C. Down 10 - 25%

D. Down 25 - 50%

E. Down more than 50%

6. How has private equity investment appetite changed?

A. Unchanged from Jan & Feb

B. Unlikely to acquire in Q2

C. Unlikely to acquire in 2020

D. Wait-and-see mode

7. How are lenders behaving with respect to existing credits?

A. No change

B. Forbear on broken covenants

C. Moving more credits to workout

D. Calling in lines of credit

8. How are mezzanine lenders behaving for new opportunities?

A. Deals closing, terms consistent with pre-Feb deals

B. Deals closing, changes to terms

C. Stalled, pending market conditions

Comments from survey respondents:

“Really tough to say for sure on these questions - too early. But lenders are tightening leverage finance pricing/terms. Everybody is wait-and-see. PE is holding back "dry powder" to provide cash to existing portfolio companies. Hoping existing lenders will step up, but concern that credit won't be available even for long-term, good borrowers.”

“Answers to these questions vary widely depending on the industry. Some are up, some are down, some are unchanged. Also varies by size of the deal and whether or not the buyer is a strategic.”

“Funds aren't going to close any deals until things settle down, if for no other reason than LPs would think they were nuts to do so.”

“More opportunities in the market are likely to appear post COVID-19 (in 3 months) but market likely to exercise more caution.”

“More opportunities for special opportunity M&A. High quality targets are more receptive for proposals.”

“No big changes yet. One deal, with fracking exposure is suspended. Others who are enhanced by this environment are moving nicely to close.”

“Not losing deals but many are being deferred and will wait until the pandemic has subsided.”

“Business success and valuations will be largely linked to the sector in which they operate.”

“90% of our current transactions are moving forward as planned, some have supply chain issues.”

“Buyer activity has virtually dried up. Sellers are now nervous as their business value decreases.”